Nvidia vs AMD: What is the Better Semiconductor Stock?

The stock market sell-off amidst the coronavirus scare has created an opportunity for long-term investors to buy high-growth stocks at a cheap price. Last year, five semiconductor stocks made it to the top ten performers of the S&P 500. Advanced Micro Devices (AMD) was the best S&P 500 performer in 2018 and 2019 and Nvidia (NVDA) in 2020, growing ~10% YTD (year-to-date)

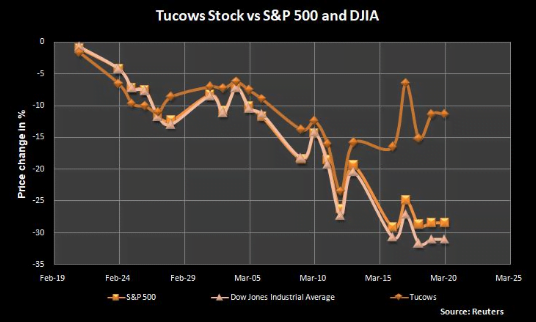

The US and China are the two major semiconductor markets. They are also the epicenters of coronavirus. Investors feared that the resulting lockdown from the pandemic would disrupt semiconductor supply and delay demand, sending AMD’s and Nvidia’s stocks down over 34% between February 19 and March 16. However, this sell-off opened a buy window.