Join 34,000+ Traders & Investors by getting our FREE weekly Sunday Cheat Sheet email. Get key market news and events before everyone else. Click Here to See if you Qualify.

On March 26, stock markets showed early sign of recovery after over a month of decline. Most cities across the globe have been quarantined because of the coronavirus pandemic making working from home the new normal. This work from home boost has proved to be a boon to SaaS (software-as-a-service) and telecommunication companies.

Two tech stocks benefiting the most from the work from home trend are video conferencing company Zoom Video Communications (ZM) and collaborative-communications software Slack Technologies (WORK). These stocks surged 2.2% and 10% on March 26, and 110% and 29% YTD (year-to-date), outperforming the S&P 500 Index and Nasdaq Composite Index. Walking on similar lines, stocks of peers Citrix (CTXS), Okta (OKTA), Cisco Systems (CSCO), and LogMeIn (LOGM) also rose on March 26.

Zoom and Slack witness

Zoom Vs Slack Stock Comparison: Two Tech Stocks Well Poised to Crush the Market in 2020

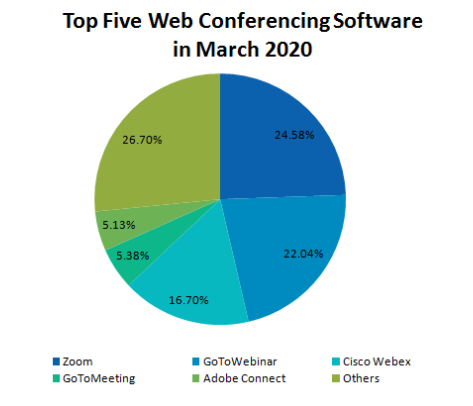

Stocks of both Zoom and Slack outperformed the market as they witnessed a sudden surge in the number of active users. Zoom mobile app downloads across all app stores increased by 2.2 million from ~170,000 on February 15 to 2.4 million on March 25, reported VentureBeat citing data from Apptopia. Zoom overtook GoToWebinar to become the leader in web conferencing market with 24.58% market share, according to Datanyze.

Source: Datanyze

On the other hand, Slack added approximately 7,000 new paid customers in 47 days from February 1, to March 18, 2020, according to its SEC filing. This marks a 40% increase compared to ~5,000 new paid customers added in the last quarter. If this momentum continues, Slack could add 9,000 new paid customers in the quarter ending April 30, estimates another VentureBeat article.

Back in 2019, when Zoom and Slack launched their IPO, they might have never expected such a surge in their user base. It is this sudden surge in work from home amidst the coronavirus pandemic that could enable Zoom and Slack to crush the market in 2020. Let us look at the two companies’ business model to understand how the new pandemic will benefit investors.

Zoom Video Communications’ business model

Zoom Video Communications is a cloud-based audio and video conferencing company founded by Eric Yuan in 2011. Zoom’s video-first platform is easy-to-use and scalable from one-on-one chat sessions to group calls to webinars and global video meetings accommodating up to 1,000 participants and displaying up to 49 HD videos on one screen at a time.

Zoom uses a “freemium” business model, under which the basic package (100 users for 40 minutes meeting) is free followed by different paid plans depending on the number of participants and meeting length. The company already overtook its competitors Cisco Webex and LogMeIn GoToMeeting to become a market leader. Zoom launched is IPO in April 2019, trading at $65 on its first day on April 22, 2019. Since then the stock rose 150% to as high as $164.94 in March 23, 2020.

Zoom’s strong financials

Even before the coronavirus pandemic, Zoom reported strong earnings growth. In fiscal Q4 2020 ended January 31, 2020, Zoom’s revenue rose 78% YoY (year-over-year) to $188.3 million driven by 61% growth in the number of customers with at least 10 employees. Its EPS rose to $0.05 from $0.01 in fiscal Q4 2019. It expects fiscal Q1 2021 revenue to reach $200 million beating analysts’ estimate of $185.6 million by 7.8%.

With the urgency of work from home, Zoom saw a significant surge in its usage, but most of the users are taking the free service, explained CFO Kelly Steckelber in the fiscal Q4 2020 earnings call. It remains to be seen how many of these users upgrade to premium packages, enabling Zoom to beat its guidance. However, many analysts are bullish on Zoom and have revised their estimates, thereby increasing the consensus revenue estimate by 167% and EPS estimate by over 115%, noted Zacks.

Zoom’s stock valuation

Looking at the above fundamentals, Zoom stock is trading at a PS (price-to-sales) ratio of 56.41, which is more than double the next second-most expensive stock Okta, noted The Motley Fool. Zoom’s higher revenue growth rate supports a higher valuation as it is the future growth prospects on which investors are betting.

The Street, citing RBC Capital analyst Alex Zukin’s sensitivity analysis for Zoom, noted that if increasing downloads convert into paid customers, it will add $337 million in Zoom’s fiscal 2021 revenue. If schools and global conferences that are being cancelled in the wake of coronavirus decide to do video broadcasting, it will add to Zoom’s revenue. Such events and webinars will have thousands of participants bringing higher revenue per account.

For full year fiscal 2020, Zoom’s revenue rose 88% YoY to $622.7 million. It is guiding revenue of $910 million for fiscal 2021, whereas some analysts estimate Zoom’s revenue to reach $1.2 billion. Analysts are divided on the stock. Morningstar analyst Dan Romanoff is bearish on Zoom given its high valuation. FBN Securities Shebly Seyrafi is neutral on Zoom given the company’s past earnings beat and its ability to beat its own guidance assuming no sharp declines in work from home.

Slack business model

Slack was founded in 2009 as a work communication platform that allows sending messages, documents, and images to individuals and groups with ease. Apart from messaging, Slack offers limited video call and screen share features on its app. It faces strong competition from Microsoft Teams and Google, the leaders in work communication space. Slack launched its IPO in June 2019 when the stock reached $42. Since then, it traded below $35.

Like Zoom, Slack also operates on a freemium model where it offers basic features for free and additional features for a premium. Its growth lies in converting free users to paid customers and retaining them. It is looking to grow by acquiring larger corporate clients.

In fiscal Q4 2020, Slack’s revenue rose 49% YoY to $181.9 million driven by a 25% increase in paid customers to 110,000. Of the 110,000 paid customers, 893 had annual recurring revenue of over $100,000, up 55% YoY, and 70 had annual recurring revenue of over $1 million. It had a net dollar retention rate of 132%. The company reduced its non-GAAP net loss to $0.04 per share from $0.23 in fiscal Q4 2019. It is looking to tap the enterprise market by integrating its platform into larger services like Amazon Chime, Cisco‘s Jabber, and Microsoft Teams in the first half of 2021.

When the company reported the above earnings on March 12, its stock fell 20% on weaker guidance that included the coronavirus uncertainty, according to CNBC. It guided revenue growth of 38% YoY in fiscal Q1 2021 and 35% in full fiscal 2021, slower than 57% in full fiscal 2020. Slack CEO Stewart Butterfield noted that while the growing trend of work from home presented opportunity, there was a risk from disruption in business travel. Moreover, it is unclear whether the increased demand from the work-from-home trend will last after the business normalizes.

Should you buy Zoom and Slack now?

The recent stock rally of Zoom and Slack came due to increasing buying activity after March 16. This rally drove the stocks above their 50-day moving average of $100.51 and $24. They are currently trading at $141 and $28. These stocks are highly volatile as their growth momentum is directly co-related to the development in coronavirus pandemic.

Zoom and Slack will disrupt the market as more people work from home. However, it remains to be seen whether they are able to retain these new customers after the coronavirus pandemic is over. This is a good time to hold than buy.

This Options Discord Chat is The Real Deal

While the internet is scoured with trading chat rooms, many of which even charge upwards of thousands of dollars to join, this smaller options trading discord chatroom is the real deal and actually providing valuable trade setups, education, and community without the noise and spam of the larger more expensive rooms. With a incredibly low-cost monthly fee, Options Trading Club (click here to see their reviews) requires an application to join ensuring that every member is dedicated and serious about taking their trading to the next level. If you are looking for a change in your trading strategies, then click here to apply for a membership.