Join 34,000+ Traders & Investors by getting our FREE weekly Sunday Cheat Sheet email. Get key market news and events before everyone else. Click Here to See if you Qualify.

The world has experienced several major financial crises in the last few decades. Growing debt is one of the significant factors in unstable economic conditions worldwide, which has led to collapsing economies in different countries.

A growing number of countries worldwide once again find themselves teetering on the edge of a national debt crisis, facing severe challenges in managing their debt burdens and ensuring sustainable economic growth.

Mounting debt-to-GDP ratios, economic instability, and fiscal vulnerabilities have put these nations at significant risk.

Let’s explore the ten countries particularly vulnerable to a national debt crisis and examine the factors contributing to their precarious situations.

Venezuela

Teetering on the Edge: 10 Countries in Dire Risk of a National Debt Crisis

- Venezuela

- Japan

- Greece

- Sudan

- Lebanon

- Eritrea

- Singapore

- Libya

- Italy

- Bhutan

- Profitable Stock Traders are Using This Tool to “Hack” the Markets

- 10 Industries That Will Make The Most Millionaires In The Next 5 Years

- 8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

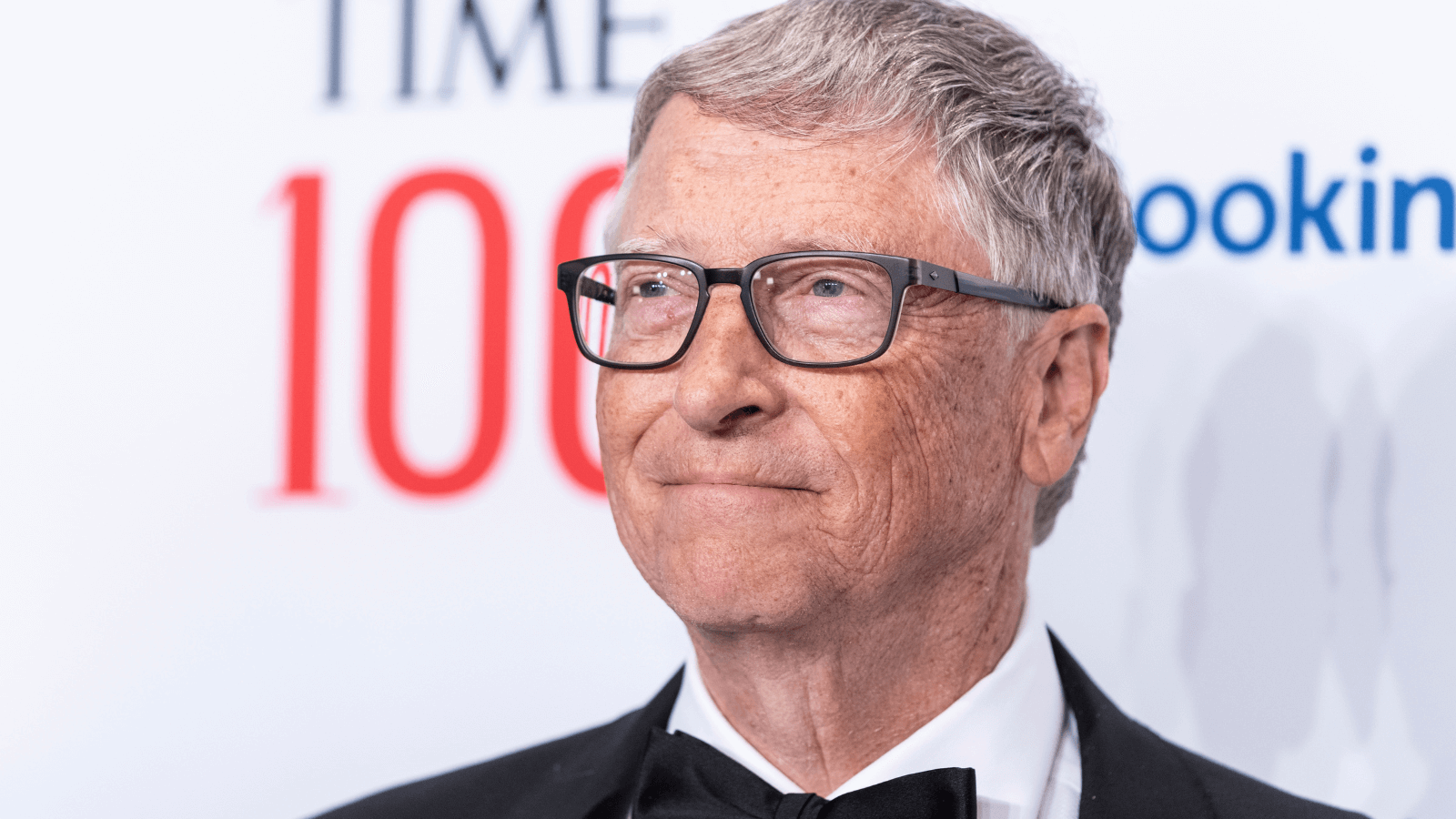

- 10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

- Top 28 Best Stock Market And Investing YouTube Channels Right Now

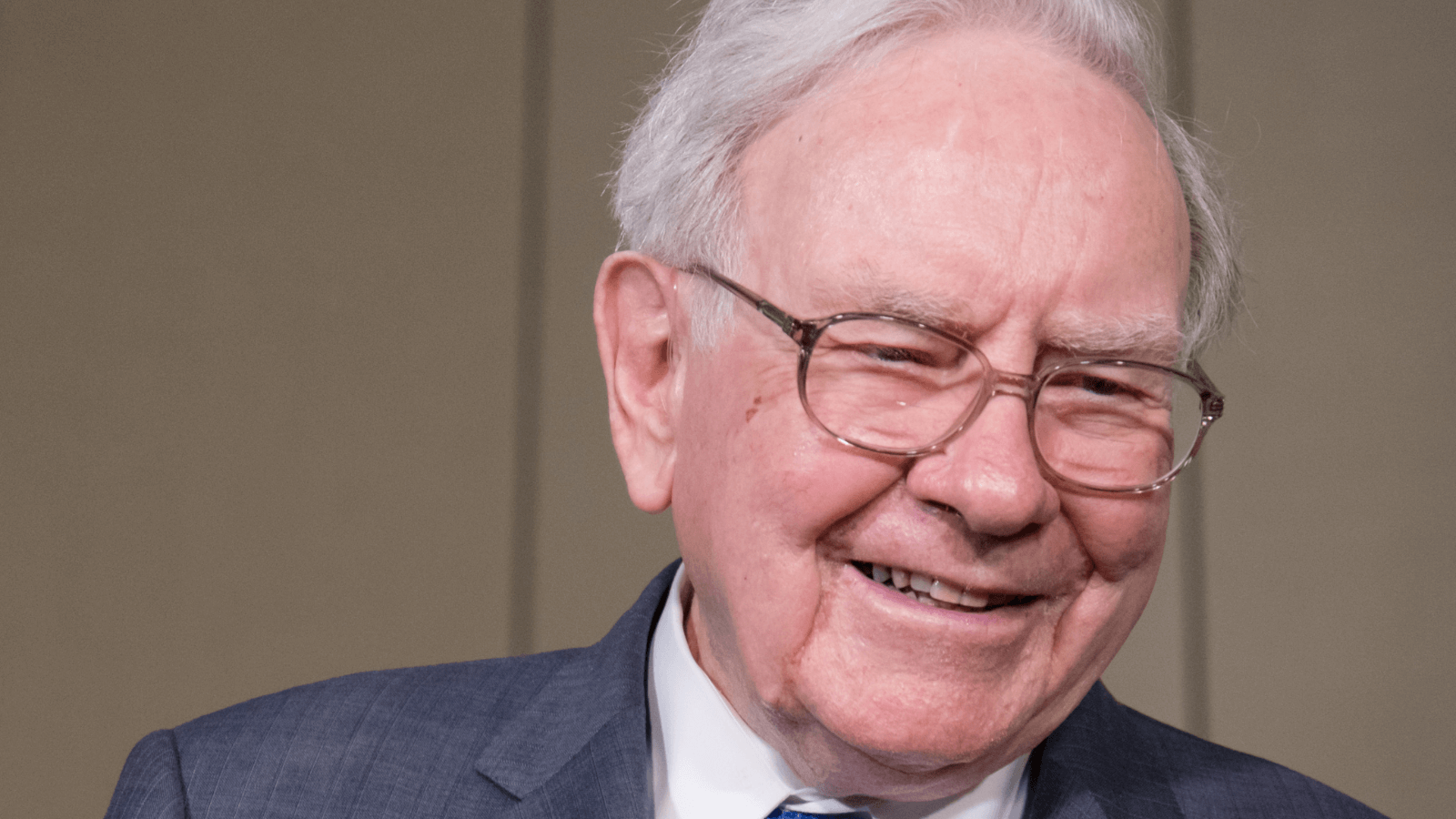

- Top 6 Personality Traits Of Highly Successful Investors And Traders

Venezuela tops the list with a staggering debt-to-GDP ratio of 350%. The country has been grappling with political and economic turmoil for years, compounded by mismanagement, corruption, and declining oil revenues. Venezuela is also severely affected by international sanctions for the last many years.

Hyperinflation, a collapsing economy, and political instability have pushed Venezuela to the brink of a debt crisis. The situation has led to capital flight as businesses have moved to more stable regional countries.

Japan

Japan faces the second-highest debt-to-GDP ratio at 266%. The country’s aging population, slow economic growth, and high public debt pose significant challenges. With such high debt taken by the government, private entities often need more cheap financing.

Despite its substantial debt burden, Japan has managed to avoid a crisis thus far, thanks partly to its ability to borrow domestically. Japan’s majority debt is local, which means it is from the citizens’ savings. However, with an aging population, Japan may face fewer savers problems in the next few decades.

Greece

Greece experienced a severe debt crisis and continues to struggle with a debt-to-GDP ratio of 206%. The country has implemented austerity measures and received bailout packages from the European Union, but its debt burden remains high.

Greece faces ongoing challenges with slow economic growth, high unemployment rates, and the need for structural reforms. With a sovereign debt crisis and an unstable banking system, the country must address these problems.

Sudan

Sudan has a debt-to-GDP ratio of 182%, placing it at significant risk. Political instability, armed conflicts, and economic mismanagement have ravaged the country’s economy. Its limited economy focuses primarily on agriculture and needs to diversify.

Sudan faces external debt challenges, limited access to international financing, and a pressing need for debt relief and economic reforms. Better governance, poverty alleviation, and more economic opportunities can help the country prosper and escape the debt trap.

Lebanon

With a debt-to-GDP ratio of 172%, Lebanon is mired in a severe economic and financial crisis. The country faces political instability, a weak governance system, and a deteriorating economic situation. The less-than-required energy infrastructure is yet another challenge.

Lebanon’s debt burden, coupled with a currency crisis, high inflation, and social unrest, has pushed it to the brink of a debt crisis. The influx of refugees from neighboring countries only helps some of these issues. These refugees will probably lead to even more unemployment in the country.

Eritrea

Eritrea has a debt-to-GDP ratio of 165% and faces economic challenges due to limited natural resources, political repression, and international sanctions. The country relies mainly on agriculture, and people need easy access to financing.

The country struggles with low economic diversification, weak infrastructure, and limited access to international financial markets, making it highly vulnerable to a debt crisis. The government needs human resource development, more significant infrastructure development, and a focus on mining the country’s national resources.

Singapore

Despite being a developed nation, Singapore has a debt-to-GDP ratio of 160%, highlighting its high level of indebtedness. The country faces economic challenges from its heavy reliance on exports, particularly in manufacturing.

Singapore’s debt burden and global economic uncertainties pose risks to its financial stability. Currently, its economy and financial health are good. Singapore should focus on its core strengths to ensure that the high debt-to-GDP ratio doesn’t hurt it in the longer run.

Libya

With a debt-to-GDP ratio of 155%, Libya faces economic challenges due to political instability, armed conflicts, and a struggling oil sector. The country has failed to rebound after the fall of the long-standing dictator Moammar Qazzafi.

The country’s debt burden, security concerns, limited infrastructure, and governance issues exacerbate its debt crisis risk. It needs to control corruption, diversify the economy instead of relying purely on oil, and look to create more jobs for the people.

Italy

Italy, the third-largest economy in the Eurozone, has a debt-to-GDP ratio of 156%. The country struggles with slow economic growth, high unemployment rates, and political uncertainty. Tax evasion is yet another problem for the European nation.

Italy’s enormous debt burden makes it susceptible to market pressures and challenges its fiscal sustainability. The Southern regions of the country could be more economically prosperous. The government is also facing low birth rate issues and low employment levels among the youth.

Bhutan

With a debt-to-GDP ratio of 135%, Bhutan faces challenges despite its efforts to pursue sustainable development and maintain fiscal discipline. The country relies mainly on agriculture, limited tourism, and foreign remittances.

The country’s debt burden, dependence on hydropower exports, and vulnerability to external shocks put it at risk of a debt crisis. Employment opportunities are few, and there is a need to develop infrastructure to help the economy.

Conclusion

The ten countries outlined above face significant national debt crisis risks due to factors such as high debt-to-GDP ratios, economic instability, political turmoil, and external vulnerabilities.

Managing debt burdens, implementing structural reforms, promoting economic diversification, and fostering political stability is crucial for these countries to mitigate the risks and chart a path toward sustainable economic growth.

International cooperation, debt relief initiatives, and targeted support are essential to assisting these nations in navigating the challenging road ahead.

Profitable Stock Traders are Using This Tool to “Hack” the Markets

This tool is helping traders beat the market compared to those who have no idea what is. Here are the Top 28 Stock Trading Discord Servers Right Now.

10 Industries That Will Make The Most Millionaires In The Next 5 Years

If you are not paying attention to these 10 industries, you are about to miss out on the next boom of millionaires. See the 10 Industries About to Make the Most Millionaires in the Next 5 Years.

8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

These are 8 cryptocurrencies you need to know about before you miss out on the next boom. 8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

We share the top 10 stocks that Bill Gates owns that smart investors are buying right now. 10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

Top 28 Best Stock Market And Investing YouTube Channels Right Now

The best investors are always learning. YouTube is one of the best free resources to learn from experts. Here are the top 28. Top 28 Best Stock Market and Investing YouTube Channels Right Now

Top 6 Personality Traits Of Highly Successful Investors And Traders

From Warren Buffett to Ray Dalio. We breakdown the top 6 common traits the most successful investors and traders have. Top 6 Personality Traits Of Highly Successful Investors And Traders

This Options Discord Chat is The Real Deal

While the internet is scoured with trading chat rooms, many of which even charge upwards of thousands of dollars to join, this smaller options trading discord chatroom is the real deal and actually providing valuable trade setups, education, and community without the noise and spam of the larger more expensive rooms. With a incredibly low-cost monthly fee, Options Trading Club (click here to see their reviews) requires an application to join ensuring that every member is dedicated and serious about taking their trading to the next level. If you are looking for a change in your trading strategies, then click here to apply for a membership.