Join 34,000+ Traders & Investors by getting our FREE weekly Sunday Cheat Sheet email. Get key market news and events before everyone else. Click Here to See if you Qualify.

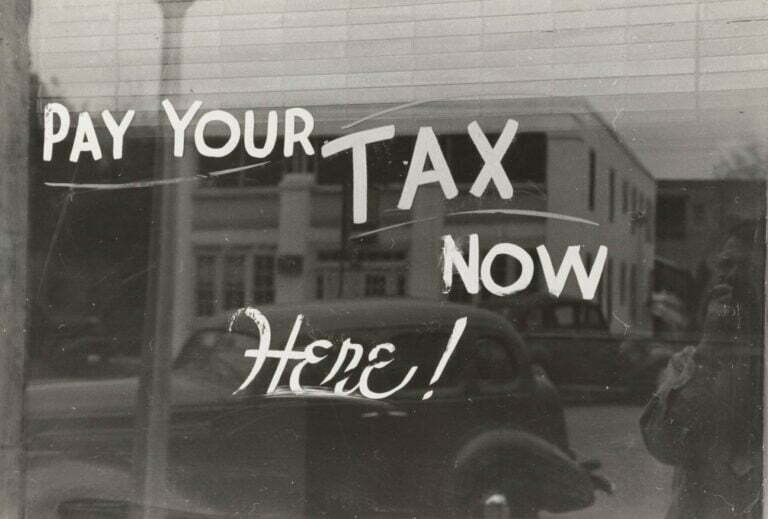

A stock market is a place where you can get high returns by staying invested in the next Apple or Google. You must have heard tales of how people who invested $5,000 in Apple in the 2009 crisis earned millions. But no one ever talks about how much tax that person paid on his/her investment income. The Canada Revenue Agency (CRA) has created a savings account that allows you to keep all your investment income to yourself without worrying about taxes. The name talks for itself, the Tax-Free Savings Account (TFSA).

How the tax-free portion of the TFSA works

How to Trade Stocks Using Your TFSA Without Getting a Huge Tax Bill

The TFSA is one place where you can invest in stocks, bonds, ETFs, mutual funds, and GICs traded on designated exchanges. This means you can invest in securities trading on the TSX, the NASDAQ, and the NYSE. The only prerequisite for opening a TFSA is you should be above 18 years of age and have a valid Social Insurance Numbers (SIN).

The CRA created the TFSA in 2009 to encourage Canadians and those residing in Canada to save. The encouragement works this way; the CRA tells you how much to contribute towards your TFSA every year. It doesn’t give you any tax benefits on the contribution. But it exempts the investment income that you earn from the TFSA in the form of a dividend, interest, and capital appreciation from taxes.

This tax benefit makes TFSA apt for high growth and high dividend stocks where your investment income is higher than your contribution. For instance, the CRA set the 2020 TFSA contribution limit at $6,000. Annie invested $3,000 in Shopify stock in April 2020 and sold it in December 2020. Her $3,000 became $5,500, resulting in an investment income of $2,500. The CRA will add the $3,000 contribution to the taxable income but exempt $2,500 investment income from taxes.

The CRA can still tax your TFSA income

The TFSA rules are clear, and if you breach any of them, the CRA imposes a 1% tax on the TFSA contribution. It also removes the TFSA tax benefit. Let’s see how.

What is the penalty for TFSA over contribution?

Every year, the CRA sets a contribution limit and allows you to carry forward the unused contribution to the next year. If you were above 18 in 2009 and were living in Canada all this while, you can contribute up to $75,500 (contribution room) in the TFSA. If you contribute more than your contribution room, the following will happen:

-

The CRA will levy a 1% tax for every month the surplus contribution stays in your TFSA.

-

It will also tax any income you earn from the surplus contribution like a regular investment income.

You can avoid this tax by withdrawing the surplus contribution on the same month you over-contribute. The CRA does not charge you 1% tax for the month you withdraw the surplus.

Let’s understand with the help of an example. Patrick turned 18 this year and contributed $8,000 to his TFSA in February, leading to an over-contribution of $2,000. He does not withdraw the surplus amount until July and earns 10% capital gain from the $2,000. The CRA will levy an over-contribution tax of $100 (1%*$2,000 for five months) and the federal and provincial tax on the $200 investment income.

Non-resident

The TFSA tax benefit is only for those residing in Canada. If you live outside of Canada for a major portion of the tax year, the CRA considers you a non-resident for that year. If you contribute to your TFSA when you are not a resident of Canada, the CRA will levy tax in the same way for over-contribution. However, the solution for non-residents will differ.

As the TFSA benefit does not apply to non-residents, your contribution room is zero. So you have to withdraw all your contributions as a non-resident to avoid the TFSA tax.

It will be clear with an example. Mary has a TFSA contribution room of $2,000. However, she went abroad for further studies and returned only for vacation. While she was abroad, she contributed $3,000 in her TFSA in June and did not withdraw until December when she returned for vacation. She earned $150 on her surplus contribution. The CRA will charge:

-

A non-resident tax of $180 (1%*$3,000 for 6 months),

-

An over-contribution tax of $60 (1%*$1,000 for 6 months),

-

And the federal and provincial tax on the $150 investment income.

How can I day trade using my TFSA?

You can’t. Not many people know about this, but the CRA can also tax your TFSA income if you use this account for professional stock market trading. Now there is no particular threshold or clear guideline on what constitutes high-frequency trading. But intra-day trading is definitely a no in the TFSA. Even if you trade on TFSA every second day, it will come under the CRA’s scrutiny.

The CRA created the TFSA as a savings instrument where you can earn investment income. But if you trade a lot, the CRA might look at you as a broker and the income you earned from trading as business income. You will lose your tax benefit, and the CRA will tax your entire TFSA income.

Think of it this way, you will attract the CRA’s attention if you have more than $1 million in TFSA in less than 10 years. Now you can earn a million dollars on $75,500 cumulative contributions if you made windfall gains over the years in some high-growth stocks. But there wasn’t a lot of trading and the income was from long-term investing, then you need not worry.

If you invest in good quality stocks for the long term within the contribution limit of the TFSA, you can reap the rewards in a tax-efficient manner.

This Options Discord Chat is The Real Deal

While the internet is scoured with trading chat rooms, many of which even charge upwards of thousands of dollars to join, this smaller options trading discord chatroom is the real deal and actually providing valuable trade setups, education, and community without the noise and spam of the larger more expensive rooms. With a incredibly low-cost monthly fee, Options Trading Club (click here to see their reviews) requires an application to join ensuring that every member is dedicated and serious about taking their trading to the next level. If you are looking for a change in your trading strategies, then click here to apply for a membership.