Join 34,000+ Traders & Investors by getting our FREE weekly Sunday Cheat Sheet email. Get key market news and events before everyone else. Click Here to See if you Qualify.

Real estate markets are generally considered the safest investment option globally. They’re often recession-proof, and property values are retained and appreciated over time.

The real estate market is a complex ecosystem influenced by various factors, including regional and local market dynamics, economic conditions, and broader market trends.

While predicting a real estate market crash with absolute certainty is challenging, there are warning indicators that, when evaluated collectively, can provide valuable insights into the potential risks and vulnerabilities within a specific region.

This discussion will explore ten warning indicators of an impending real estate market crash, considering regional and local market factors, economic indicators, and market conditions.

Overvalued Prices

Avoid the Collapse: 10 Unmistakable Signs of an Approaching Real Estate Market Crash

- Overvalued Prices

- High Housing Affordability Index

- Excessive Speculation

- High Mortgage Delinquency Rates

- Tightening of Lending Standards

- Increasing Interest Rates

- Oversupply of Inventory

- Economic Downturn

- Decreasing Rental Demand

- Stock Market Volatility

- Conclusion

- Profitable Stock Traders are Using This Tool to “Hack” the Markets

- 10 Industries That Will Make The Most Millionaires In The Next 5 Years

- 8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

- 10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

- Top 28 Best Stock Market And Investing YouTube Channels Right Now

- Top 6 Personality Traits Of Highly Successful Investors And Traders

Rapidly rising home prices that outpace income growth and rental rates can indicate an overvalued market. Too many investors looking for properties in the same area can be a trigger.

This warning sign becomes more relevant when considering the specific region, as local economic conditions and supply-demand dynamics play a crucial role in determining the sustainability of price increases.

High Housing Affordability Index

Examining the housing affordability index in a specific region provides insights into the ability of the population to afford homeownership.

If the index indicates that housing has become increasingly unaffordable due to rising prices and interest rates, it may lead to reduced demand, potentially triggering a market correction or crash.

Excessive Speculation

Excessive speculation can contribute to an unsustainable real estate market, particularly in local markets. It can be a significant component in impending trouble.

When investors engage in speculative buying, solely driven by short-term gains rather than considering long-term economic fundamentals, it can create artificial demand and increase the risk of a market crash when the speculative bubble bursts.

High Mortgage Delinquency Rates

Increasing mortgage delinquency rates within a specific region signify homeowners struggle to make their mortgage payments. 2008’s property market crash teaches us that a repeat is possible.

This indicator suggests financial stress among borrowers and highlights potential vulnerabilities in the local market, potentially leading to increased foreclosures and declining property values.

Tightening of Lending Standards

When banks and financial institutions tighten their lending criteria, it becomes more difficult for prospective buyers to secure mortgage loans.

This tightening can reduce buyer demand and slow the real estate market, potentially leading to a correction or crash.

Increasing Interest Rates

Rising interest rates can have a significant impact on the real estate market. As borrowing costs increase, affordability decreases, making it more challenging for buyers to enter the market.

This decrease in demand can put downward pressure on prices and contribute to a potential market crash.

Oversupply of Inventory

An oversupply of available properties can result from an excessive surge in new construction or a decline in demand.

When the number of properties on the market exceeds the number of buyers, it can lead to a supply-demand imbalance, causing prices to decline and potentially triggering a market correction or crash.

Economic Downturn

The real estate market is closely linked to the overall economy. During periods of economic recession or downturn, there is a higher likelihood of a real estate market crash. Investors are careful in the current market with high-interest rates and several other indicators suggesting another possible correction.

Economic factors such as job losses, reduced consumer spending, and declining business activity can significantly impact the housing market, decreasing demand and falling property values.

Decreasing Rental Demand

The rental market can provide valuable insights into the real estate market’s health. If rental demand significantly decreases, it may indicate weakening market fundamentals, such as declining population growth or decreasing affordability.

A decline in rental demand can be an early warning sign of an impending real estate market crash.

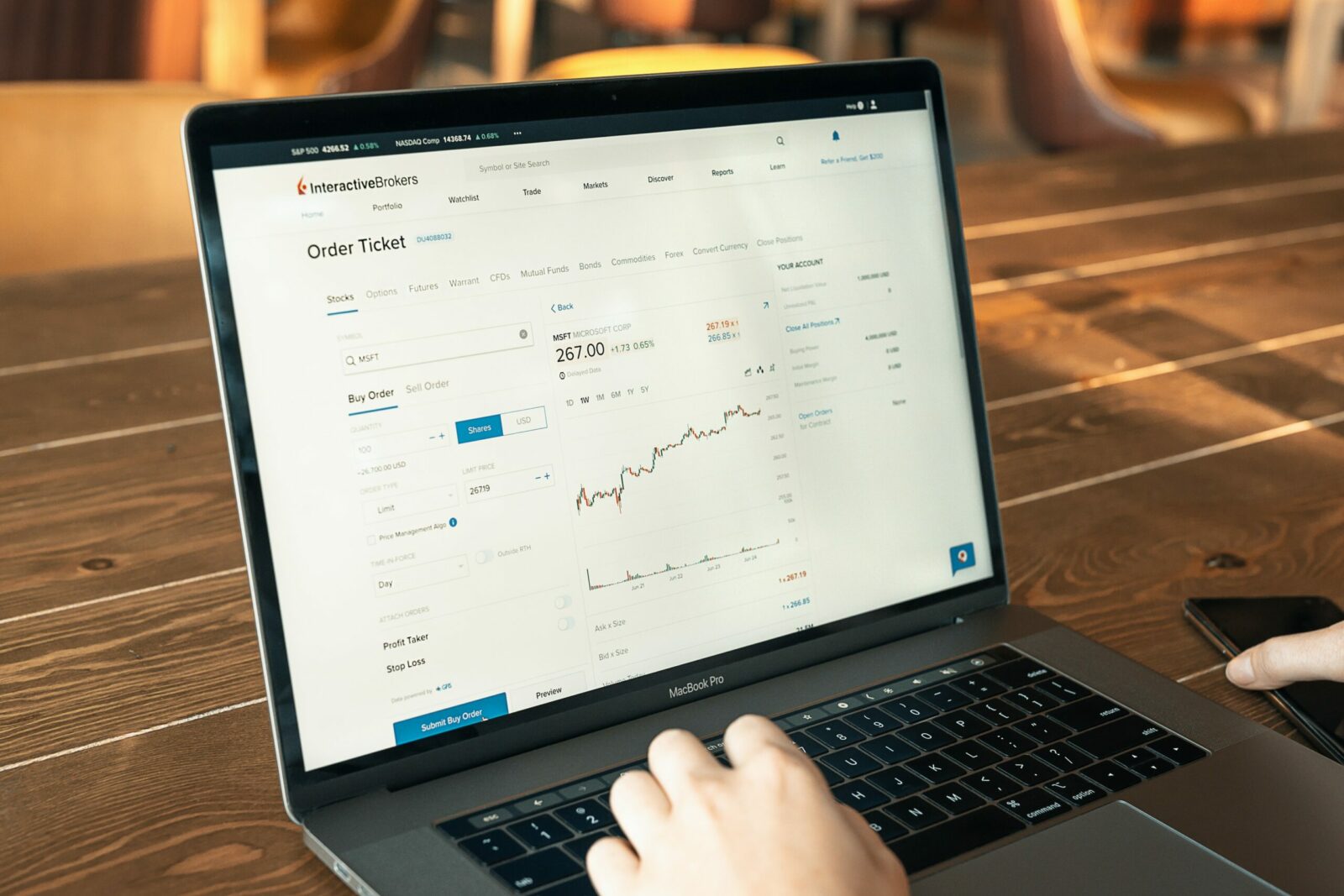

Stock Market Volatility

The performance of the stock market often influences the real estate market. If the stock market experiences a severe decline or heightened volatility, it can create uncertainty and negatively impact investor sentiment.

This, in turn, can lead to a slowdown in real estate investment activity, affecting both residential and commercial property sectors.

Conclusion

Predicting a real estate market crash requires a comprehensive analysis of various factors, including regional and local market dynamics, economic indicators, and market conditions.

The ten warning indicators discussed in this article provide a framework for evaluating a real estate market’s health and potential vulnerabilities.

However, it’s important to remember that these indicators should be considered collectively and with other economic factors and local market insights.

Engaging with local real estate professionals and economists and conducting thorough research specific to the region of interest is essential for accurate assessments and informed decision-making in the real estate market.

Profitable Stock Traders are Using This Tool to “Hack” the Markets

This tool is helping traders beat the market compared to those who have no idea what is. Here are the Top 28 Stock Trading Discord Servers Right Now.

10 Industries That Will Make The Most Millionaires In The Next 5 Years

If you are not paying attention to these 10 industries, you are about to miss out on the next boom of millionaires. See the 10 Industries About to Make the Most Millionaires in the Next 5 Years.

8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

These are 8 cryptocurrencies you need to know about before you miss out on the next boom. 8 Cryptos Set to Shoot to the Moon in 2023 – One Small Investment, One Giant Leap for Your Wallet

10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

We share the top 10 stocks that Bill Gates owns that smart investors are buying right now. 10 Stocks in Bill Gates Stock Portfolio Smart Investors are Buying

Top 28 Best Stock Market And Investing YouTube Channels Right Now

The best investors are always learning. YouTube is one of the best free resources to learn from experts. Here are the top 28. Top 28 Best Stock Market and Investing YouTube Channels Right Now

Top 6 Personality Traits Of Highly Successful Investors And Traders

From Warren Buffett to Ray Dalio. We breakdown the top 6 common traits the most successful investors and traders have. Top 6 Personality Traits Of Highly Successful Investors And Traders

This Options Discord Chat is The Real Deal

While the internet is scoured with trading chat rooms, many of which even charge upwards of thousands of dollars to join, this smaller options trading discord chatroom is the real deal and actually providing valuable trade setups, education, and community without the noise and spam of the larger more expensive rooms. With a incredibly low-cost monthly fee, Options Trading Club (click here to see their reviews) requires an application to join ensuring that every member is dedicated and serious about taking their trading to the next level. If you are looking for a change in your trading strategies, then click here to apply for a membership.