Join 34,000+ Traders & Investors by getting our FREE weekly Sunday Cheat Sheet email. Get key market news and events before everyone else. Click Here to See if you Qualify.

Much of any economy runs on the principles of supply and demand, often with cyclical changes that become predictable. In the U.S. market, many indicators may give a hint about the state of the economy.

Currently, the S&P 500 has risen 7% in the first quarter, the GDP is moving in the right direction, and the unemployment rate also suggests that all is good. One can expect to get good returns for their investments in the current situation.

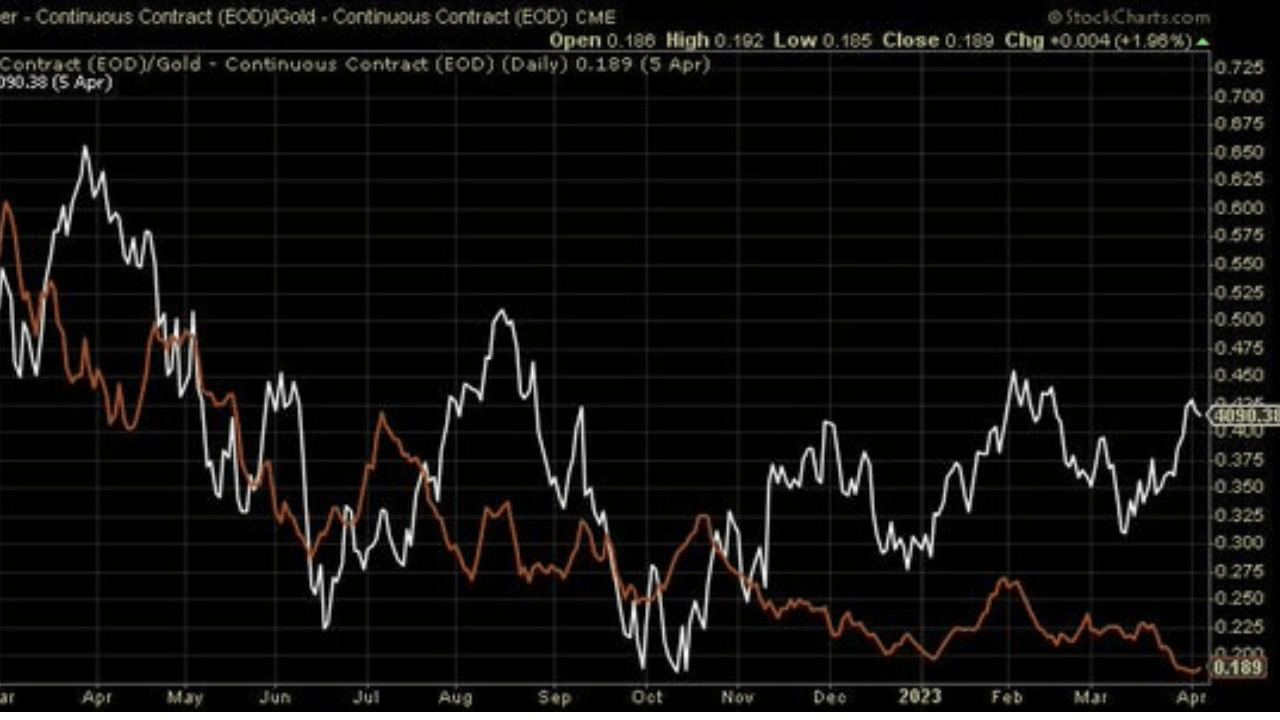

However, a Lead-Lag Report piece, by Michael A. Gayed, CFA sees the scenario differently based on one variable; the lumber price. Lumber tells the tale of the housing market, which in turn has a lot to say about the U.S. economy. Typically, whenever lumber prices have fallen, gold prices have risen.

Courtesy: The Lead-Lag Report

The report sees a likely correction of 10% to 15% just around the corner. They expect a tough time ahead for the investors despite all the current good signals.

Experts believe that the pattern indicates that the investors find solace in gold, a relatively low-risk commodity in comparison with lumber. This usually indicates a defensive approach.

The current lumber-to-gold ratio – the price of lumber divided by that of gold – has come down to 0.5 from 0.9 not too long ago. In 2018, a 0.3 ratio led to a nearly 18% dip in the S&P 500. There are, of course, historical events that suggest otherwise.

At the moment, it appears that lumber prices will continue to decline further in the months to come. Whether we are going to see a correction based on the lumber-to-gold ratio remains to be seen.

This Options Discord Chat is The Real Deal

While the internet is scoured with trading chat rooms, many of which even charge upwards of thousands of dollars to join, this smaller options trading discord chatroom is the real deal and actually providing valuable trade setups, education, and community without the noise and spam of the larger more expensive rooms. With a incredibly low-cost monthly fee, Options Trading Club (click here to see their reviews) requires an application to join ensuring that every member is dedicated and serious about taking their trading to the next level. If you are looking for a change in your trading strategies, then click here to apply for a membership.