Join the best crypto trading signals discord chatroom and join thousands in making better trading decisions. Click Here To Join!

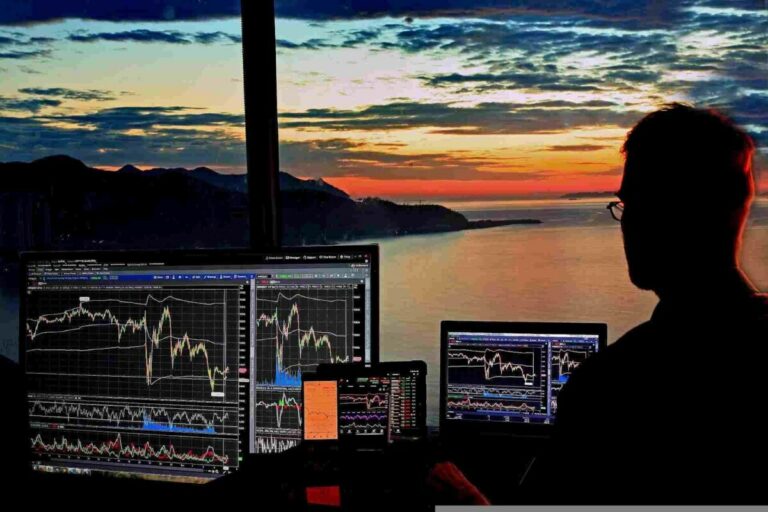

The forex vs crypto (cryptocurrency) markets are the most important financial markets in day trading, with a combined daily trading volume worth trillions. Although there are a few similarities between FX trading and crypto trading, significant differences determine profitability. Trading principles are the same across all markets, but the uniqueness of each influences how much profit traders can make. There are vital factors to consider when comparing forex profitability vs. crypto trading.

What is Forex Trading?

Forex vs Crypto Trading Beginners 2023 Explanation

The forex market is where fiat currencies are sold, bought, or exchanged at the current or future prices. Forex trading describes the action of trading currencies on the foreign exchange market. There are three types of forex trading; spot, forwards, and futures.

This form of trading is usually done OTC (over-the-counter) through brokers who act as the market makers. FX traders analyze the market through technical and fundamental analysis and can trade a wide range of assets from the major to minor and exotic currency pairs. For decades, traders have explored this market, and the number of traders has grown within the last two decades.

What is Crypto Trading?

Crypto trading is the buying, selling, or exchanging virtual/digital assets called cryptocurrencies. Bitcoin was first introduced in 2009, and within five years, other cryptocurrencies followed. There are over 14 thousand cryptocurrencies today, with Bitcoin having the most significant market share.

Crypto trading is done on exchanges that act as market makers. There are three types of crypto trading; spot, futures, and p2p trading. The high volatility of cryptocurrencies has attracted a lot of traders in the last five years. As with forex trading, crypto traders analyze the crypto market through technical and fundamental analysis.

Differences Between Forex Vs Crypto Day Trading

The following differences directly impact the profitability of both markets:

Volatility

Both forex and crypto markets experience relatively high volatility, but the forex market is characteristically higher. Cryptocurrency volatility is unpredictable, fast, and usually intense. There’s also a fundamental loophole that traders can exploit in crypto trading; a few traders may “pump” the coin’s value and remove the liquidity at a higher price, effectively liquidating other traders on the asset. Due to the rapid volatility in these, day trading is an often used strategy for both forex and crypto.

In forex trading, volatility is more controlled and predictable than in cryptocurrencies. No single person controls the price of fiat currencies. Instead, the forex market determines its value.

Regulation

Unlike forex trading, crypto trading is largely unregulated. This is partially responsible for the crypto market’s relatively high volatility and low liquidity. On the other hand, the forex market has the advantage of government backing, market capitalization, and price regulation. The forex market also has a high potential for profits.

Liquidity

The liquidity of a market determines the bid-ask spread, which determines how easy it is to trade the assets in that market. Forex trading has the advantage over crypto trading because it has more liquidity. With a liquidity worth over $6 trillion, the forex market trumps the crypto market, which comes short by a long margin.

For perspective, over $5 trillion is traded in the forex market daily, compared with the $500 billion traded in the crypto market. Since bitcoin has over 30% of the crypto market liquidity, the bid-ask spread in the crypto market is usually high. Crypto traders looking for a low bid-ask spread may be limited to only a few coins, whereas forex traders can find dozens of coins with a low bid-ask spread and enough trading volume.

Decentralization

Decentralization is one of the most significant selling points of cryptocurrencies. The crypto market is decentralized, but trading is done on decentralized exchanges (DEXs) or centralized exchanges (CEXs). They have unique advantages and drawbacks, but crypto traders can use either or both. Crypto exchanges may charge a high trading or withdrawal fee, decreasing profits. In forex trading, brokers provide a platform for retail traders to explore the financial market. Brokers get rewards through spreads and may not charge trading or withdrawal fees.

Forex vs Crypto: Final Thoughts on Profitability

Both markets have a high potential for profits due to their high volatility. The higher the volatility, the higher the profit potential. But other factors impact the profits that traders can make in either market: lot size, spread and trading fees, and asset management. Crypto traders must diversify their portfolios to increase profit potential, whereas forex traders may focus on one currency pair and make profits. In the end, crypto trading may have the edge over forex trading regarding making profits. However, there is also a high chance of getting liquidated. The forex market has low extreme price swings and thus has the edge in retaining profits.

How to Become a Profitable Forex Trader

You can become a profitable forex trader if you apply these core principles:

- Learn forex trading. Start with the basics and then the advanced concepts.

- Choose a good broker. A good broker improves your profit potential.

- Choose a profitable trading strategy. Find the strategy that fits your style best and stick with it.

- Learn and practice asset management: Protect and grow your portfolio

- Track your trading journey. Keep a trading journal and learn from it.

- Keep learning, practicing, and improving.

This Options Discord Chat is The Real Deal

While the internet is scoured with trading chat rooms, many of which even charge upwards of thousands of dollars to join, this smaller options trading discord chatroom is the real deal and actually providing valuable trade setups, education, and community without the noise and spam of the larger more expensive rooms. With a incredibly low-cost monthly fee, Options Trading Club (click here to see their reviews) requires an application to join ensuring that every member is dedicated and serious about taking their trading to the next level. If you are looking for a change in your trading strategies, then click here to apply for a membership.